Master Your Financial Future

Join our comprehensive learning program designed to transform your relationship with money through progressive skill development and practical application

Start Your JourneyYour Learning Pathway

Our structured approach takes you from financial basics to advanced wealth strategies through three carefully designed progression levels

Foundation Builder

Master the fundamentals of personal finance, budgeting, and debt management. You'll learn to create sustainable spending habits and build emergency funds.

Growth Strategist

Dive into investment principles, risk assessment, and portfolio diversification. Understand market dynamics and develop your investment philosophy.

Wealth Architect

Advanced wealth preservation, tax optimization, and legacy planning strategies. Learn to protect and grow substantial assets effectively.

Module Breakdown

Each module builds upon previous knowledge while introducing new concepts that deepen your financial expertise

Financial Mindset

- Identify and overcome limiting money beliefs

- Develop abundance thinking patterns

- Create sustainable financial habits

- Build confidence in money decisions

Budget Mastery

- Design personalized budgeting systems

- Track expenses using modern tools

- Optimize spending across categories

- Build automatic saving mechanisms

Investment Strategy

- Understand different asset classes

- Learn portfolio construction principles

- Analyze risk vs. return relationships

- Develop long-term investment plans

Risk Management

- Assess personal risk tolerance

- Choose appropriate insurance coverage

- Create emergency fund strategies

- Plan for market volatility

Tax Planning

- Understand South African tax implications

- Optimize retirement contributions

- Learn tax-efficient investment strategies

- Plan for capital gains management

Estate Planning

- Create comprehensive estate plans

- Understand trust structures

- Plan for wealth transfer

- Protect assets for future generations

Assessment & Support

Our comprehensive evaluation system ensures you master each concept before advancing, with personalized support throughout your journey

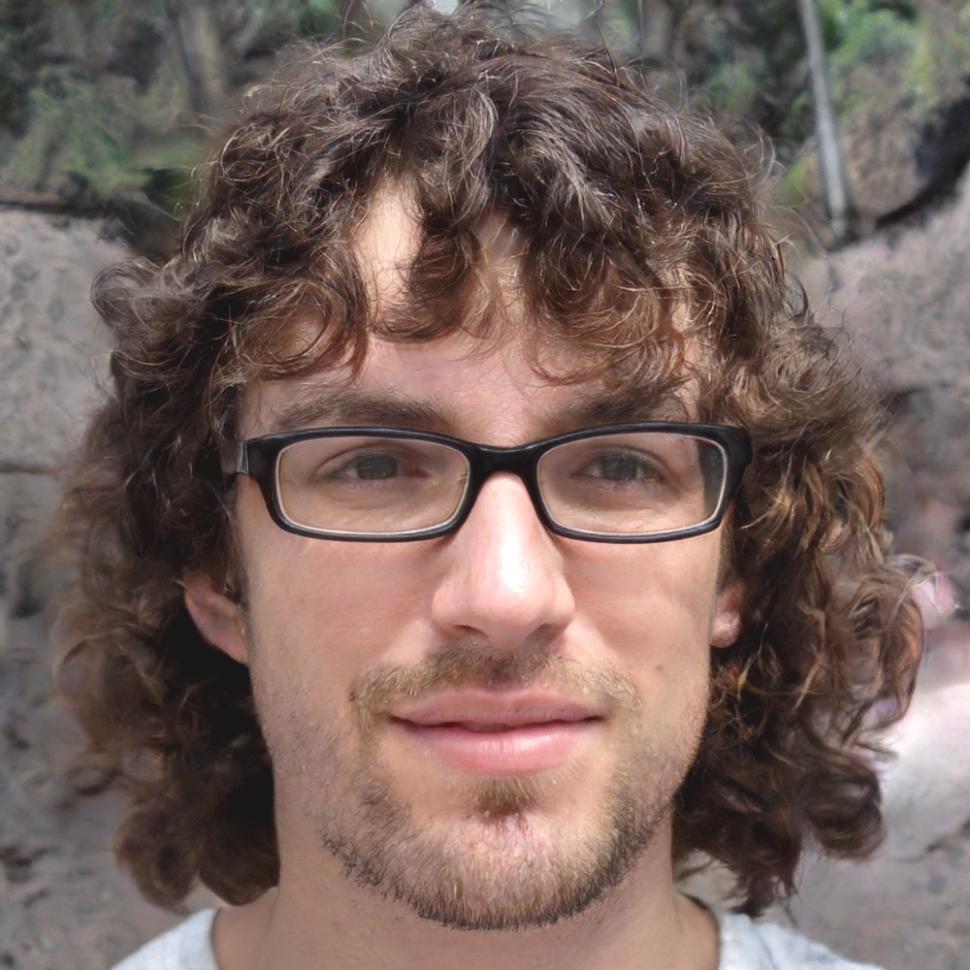

Marcus Thompson

Lead Financial Educator

With over 15 years in wealth management and financial planning, Marcus brings real-world experience to every lesson. He's helped hundreds of individuals transform their financial futures through education and practical application.

-

Knowledge Assessments

Regular quizzes and practical exercises test your understanding of key concepts. These aren't just theoretical—you'll apply what you learn to real scenarios.

-

Portfolio Projects

Build your own financial plan throughout the program. Create budgets, investment strategies, and long-term goals that reflect your personal situation.

-

Mentorship Sessions

One-on-one guidance helps you navigate complex financial decisions. Get personalized advice on your specific challenges and opportunities.

-

Completion Certification

Earn recognition for your dedication to financial education. Our certification demonstrates your commitment to sound financial principles and practices.